PSN Client Service Team will provide:

· On-line Web Training

· Telephone Support

If you need training, have questions, comments or suggestions concerning our software; please contact our PSN Client Service Team:

Client Service Support:

Phone: 800-789-5323

E-Mail: clientservices@informais.com

A Direct Path to Separate Account Data

PSN Enterprise, a product developed by Informa Investment Solutions, is the most comprehensive and easy to use investment manager database available. PSN Enterprise is a web-based application that will be the keystone in building your separate account business.

PSN Enterprise is powered by the PSN investment manager database. Since 1984, PSN has been recognized as the premier investment manager database. We earned this reputation because of PSN’s wealth of accurate data, flexibility, exclusive functions and exceptional service.

Data Integrity

Informa Investment Solutions serves as an objective, third-party supplier of information. We maintain no affiliations with any of the investment managers we track, and pride ourselves in providing purely impartial data. And all PSN information is primary data. We solicit the information directly from the source, which makes the data more consistent and reliable.

Data Breadth

PSN boasts a global database of more than 1,300 investment managers, representing more than 5,000 US, global and international investment products. This expansive database assures you a thorough representation of the investment management arena.

Data Depth

When you use PSN data in PSN Enterprise, you get immediate access to high-quality, detailed information on each firm capturing over 1,000 data points.

PSN Enterprise's investment manager profiles provide in-depth information on each manager and their product offerings, including assets, fee structure, composite holdings, and historical returns and statistics. In addition to quantitative data, PSN Enterprise also includes objective, narrative data. Categories, such as investment philosophy, portfolio construction biographies of senior investment professionals, enhance your analysis with valuable insight.

The Manager Search Made Easy

PSN Enterprise offers you unmatched power to manipulate and evaluate the wealth of information in the PSN database. Match your investment objectives with the right investment manager in minutes. All the information you need is at your fingertips.

Built-In Investment Formulas

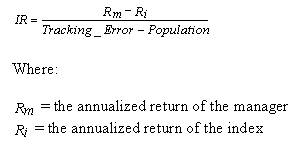

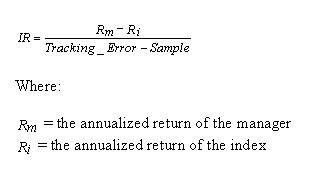

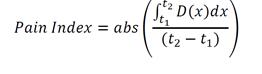

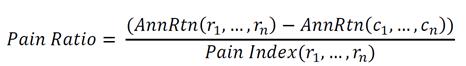

PSN Enterprise gives you the ability to measure performance, conduct detailed statistical analysis and assess risk. The system has built-in formulas for the sophisticated calculations that investment professionals require. From beta and information ratio, to downside risk and upside uncertainty, PSN Enterprise executes the calculations you need. You can select your own date ranges and benchmarks in your analysis. Or, you can use over 2 million pre-generated statistical calculations for quick performance comparisons.

Universe Comparisons

PSN Enterprise keeps it simple. We give you all the functions you need without slowing you down with too many choices to make and too many buttons to click. Either choose from our convenient pre-saved universes or screen on key data fields to create your own custom peer groups. You can save your favorite universes for later retrieval. What was once an arduous process can now be accomplished with speed, versatility and ease.

Self-Entered Module

Include proprietary information in your analysis by using the Self-Entered Module. Enter monthly or quarterly returns on any individual account, mutual fund, hedge fund, composite, index, etc. Once entered, you may include these portfolios in any of your PSN Enterprise evaluations.

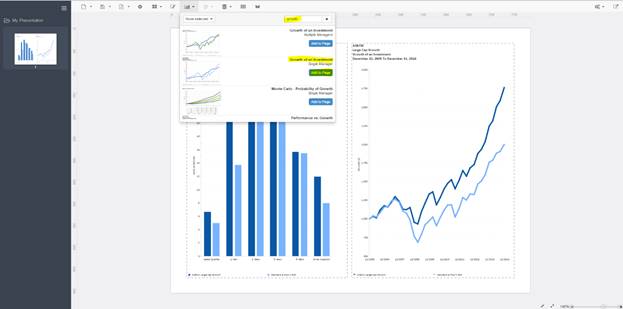

Blended Portfolio Analysis

Combine the returns of indices, investment products, or your Self-Entered data with PSN Enterprise’s blended portfolio analysis. You can even rebalance or change allocation over time. Create one or more scenarios and compare them against each other to arrive at a suitable recommendation. Once created, blends can be saved and automatically updated for future use in a new or existing report.

Style Analysis

Determine a product’s return-based style as compared to standard benchmarks. The Style Analyzer allows you to look at a manager’s style exposure and drift compared to other manager with the same investment style. Historical, rolling time period and current style analysis information can be displayed in graphical or tabular format. Style analysis is available for all major asset classes.

Asset Allocation

Before choosing allocation percentages for your blended portfolio, inspect an efficient frontier that contains a list of possible optimal portfolio combinations. Let PSN Enterprise show you the optimal solution based on your risk and return preferences. Options include manager and asset class optimization.

Report Writer

Define report columns using any data field within PSN Enterprise and arrange the information as you see fit. Your reports will be thorough and easy to understand. View it, print it or download it to an Excel spreadsheet.

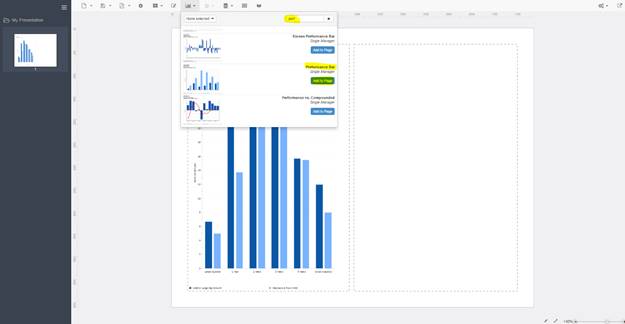

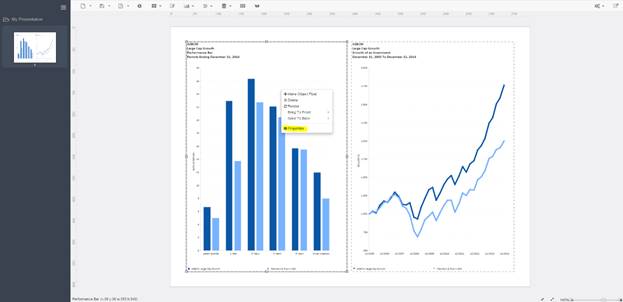

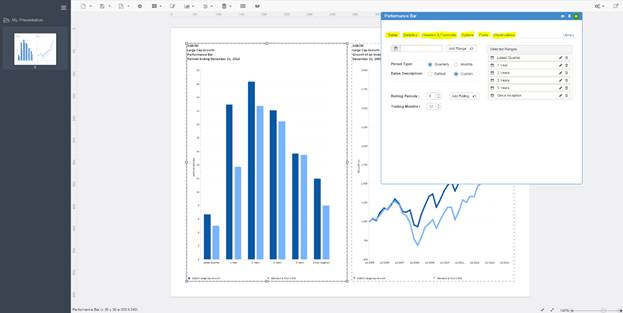

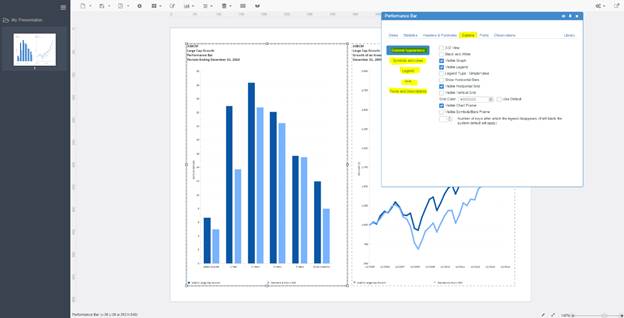

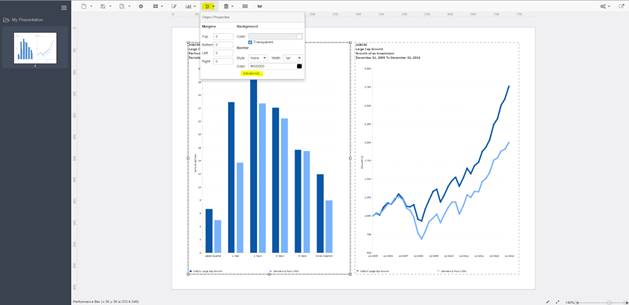

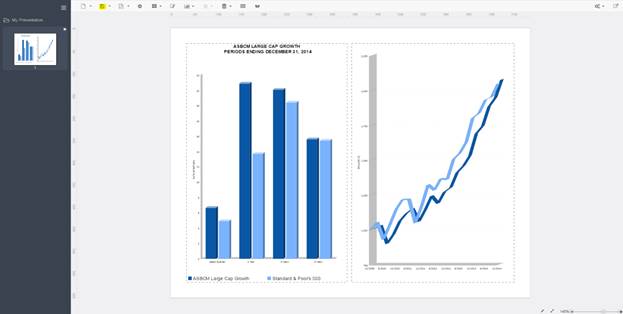

Graphs and Reports

Strengthen your comparative analysis with graphs and reports. Choose from PSN Enterprise's wide selection of options and produce professional-quality output, without utilizing different software. Customize your output by easily changing fonts, colors, styles, observations, benchmarks, date ranges and statistics. You can even import your own logo.

Modify graphs and reports for one-time use, or save them as custom templates which can be updated with new data. Graphs and reports can be saved within PSN Enterprise or exported to other Microsoft Windows software.

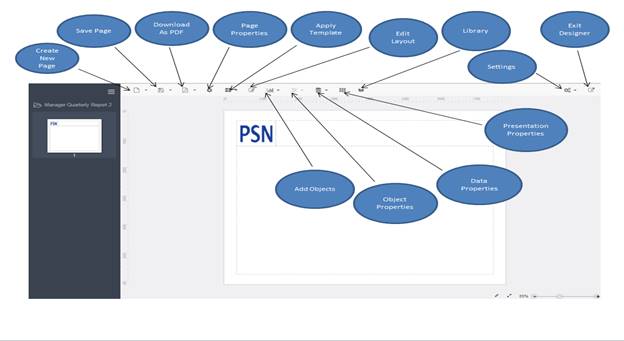

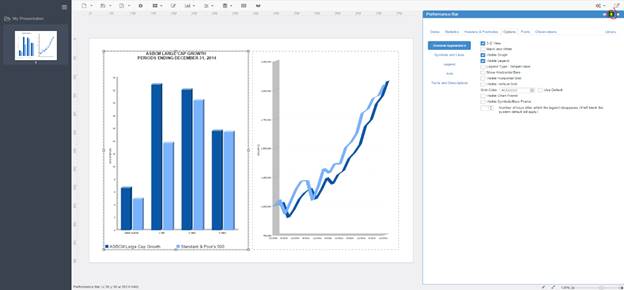

Report Designer

Report Designer will allow you to design your own report templates by combining data, graphs, text, and images. Using text blocks and graphics from our library or creating your own, you can do a side-by-side comparison of two or more managers or products, and the choice of content and placement is completely customizable. Features include drag and drop, resizing and menus to customize both individual sections of the report, or to set parameters for the entire presentation. Report templates created by the report designer can be reused and modified to meet your changing needs.

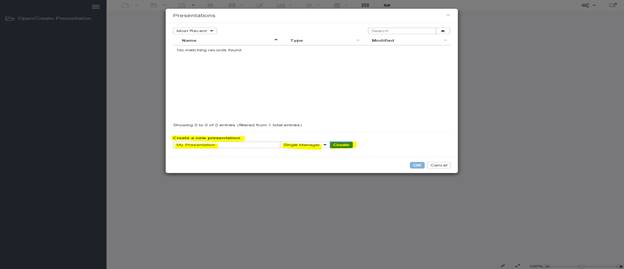

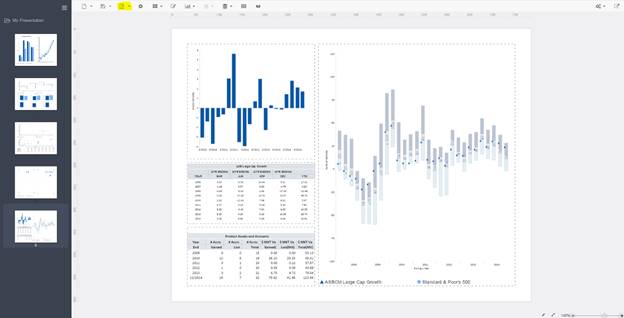

Presentation

PSN Enterprise enables you to combine multiple graph and report templates to create presentation for different clients or prospects. Maintain consistency and save time preparing for your next meeting. The instant proposal function compiles reports, graphs, market commentary, compliance information, proprietary fact-sheets, and third party output to create a complete business or client presentation. Presentations can be saved for individual use or shared between specified users.

Batch Production

Each report template in PSN Enterprise contains its own intelligence by storing the default criteria of each report. Our batch production system enables you to group multiple report templates into a single presentation. Viewing or printing a large presentation is now just a few keystrokes away.

If performance monitoring or batch reporting production is your requirement, PSN Enterprise gives you the power and ease to batch produce countless presentations quickly and efficiently.

Custom Solutions Too

Every client is different. We, at Informa Investment Solutions, pride ourselves in our ability to create custom solutions for our client’s unique needs. Add extra data fields or develop your own reports with help from our team of skilled developers. PSN Enterprise is flexible enough to handle any requirement. There is no denying that PSN is the most complete data source for separate account information. But maybe separate account information is not all your need. We made PSN Enterprise so flexible that it can handle multiple data sources, such as mutual funds, hedge funds and other investment information.

Training & Support

We provide unlimited product training and technical support. Once we get you started, we don't disappear. Our experienced support team is available to offer assistance, Monday through Friday, 8:30 AM to 6:00 PM (ET). Help is always just a phone call away.

Experience the Best

For over 25 years, Informa Investment Solutions has been providing consultants, brokers, investment managers, and plan sponsors with separate account information. Extensive data, user-friendly application, and easy deployment make PSN Enterprise the ideal separate account solution. Informa Investment Solutions has the experience and knowledge to build your separate account business.

This application has the following requirements:

Internet Explore 8.0

Google Chrome

Firefox

Mac

Informa Investment Solutions has granted the user access to the PSN Enterprise system and data based on one user connected to a functional email address. This is a web-based application it is not contingent on user location. As long as there is an Internet connection, the user will be able to gain access to PSN Enterprise using the same user name (email address) and password.

At the time of login, we will authenticate the user using information provided to us by the user’s organization. ONLY AUTHORIZED USERS WILL BE ALLOWED TO ENTER INTO THE SYSTEM.

Other users who are connected to the Internet may not use PSN Enterprise unless they are also valid users of PSN Enterprise, each with their own user name (email address) and password. Because the security is imbedded in the software, please contact us regarding new users so that we can activate each new user and give them their own access to PSN Enterprise.

To add new users, please contact your account manager for additional services.

If you need training, have questions, comments or suggestions concerning our software; please contact the client services by using one of the following methods:

E-mail: clientservices@informais.com Subject: PSN

Phone:

(775) 588-0654 | (800) 789-5323

Mail:

Informa Investment Solutions

Client Service Department

4 Westchester Park Drive

White Plains, NY 10604

Training sessions and support are available at the user’s convenience. We provide one on one as well as group training both on-site, off-site or by telephone depending on the client’s request. Once we get you started, we won't disappear. We stay behind the scenes to offer you help when it's needed. Our experienced support team is available for questions, Monday through Friday, 8:00 AM to 5:00 PM (ET). Help is always just a phone call away.

Customization

We offer product training that is tailored to meet your specific needs. By applying the principles of the product directly to your work, the training is much more effective. We will walk through real-life work scenarios together to help you apply the Informa Investment Solutions product directly to your work. We also help customize product features to your specifications to help you save time in the future.

Tiered Training

We offer three different levels of training, ranging from beginner to expert.

v Start-Up Training ~ for new users or trainers

v Brush-Up Training ~ a review of the main product features and instruction for new features

v Master Training ~ for experienced users or trainers who want to use PSN to its full potential

Flexibility

We realize that your work schedule is challenging. That's why we offer considerable flexibility in our training sessions. We will conduct training for one person, or the entire team. And, we are willing to come to you, or we can hold the training in our offices in White Plains, New York. (30 Minutes north of New York City). Though we would rather get to know you in person, we also offer training by phone.

All client service calls are returned in one business day or less. Close to 100% of calls are answered immediately or in less than one hour. There is also a help system in our software for those who prefer to figure it out for themselves.

As a user of our system, you will be provided with an online user reference guide. The guide contains quick steps on how to perform certain functions within the system. Detailed definition on data and modules are just small parts of this helpful user reference guide. To keep users informed of the latest enhancement to the product they licensed, we created IIS Messenger, our own mass email system. IIS Messenger was developed by our own programming department as a client service tool and has evolved into an Informa Investment Solutions product offering.

Every year Informa Investment Solutions surveys our clients to find out what new enhancements they would like in the product they licensed. This is done through electronic survey, phone survey, individual face-to-face meetings, as well as client group meetings. After compiling the responses, we try to best accommodate our client’s wishes.

Our philosophy is quite simple. We created databases and applications to service the investment community so feedback from the investment community is vital. Thanks to our ongoing client communication effort and our open-door policy, many improvements to our manager information system are generated from actual client comments.

When it’s time to research investment managers, we at Informa Investment Solutions understand your need for the most accurate, complete and up-to-date information. We offer you just that. In September of 2006, the industry’s two most comprehensive investment manager databases, M-Search and PSN Data, were combined to form the much enhanced PSN database.

Consistently updating and validating the data from investment managers is key to maintaining the integrity of the database and has been our core competency for more than 20 years. No one else in the industry can make that claim.

Collecting the Data

Manager Neighborhood is Informa’s central data collection site for investment managers. Due to the deep penetration of PSN data into the market, participating managers understand and appreciate the importance of including their data in the database. Informa charges no fee to investment managers for participation, and managers have 24/7 online access to Manager Neighborhood to allow for data input whenever it’s convenient for them. To ensure the most-up-to-date information, managers must report on a regular basis in accordance with published deadlines.

Validating the Data

Because the quality and reliability of the data is as important as the quantity of information provided in the database, data completeness and accuracy are crucial. Data analysts of the M-Search and PSN teams have been combined to form a dedicated, highly knowledgeable team working together to apply best practices in data validation. Each member of our experienced team of data analysts is assigned to specific managers with whom they work closely to secure and validate the data.

The PSN database is powered by a rigorous data validation process designed by Informa that incorporates steps to ensure that the most complete and accurate data resides in the database at all times. Our process consists of four separate checks to provide data validation prior to the uploading of information to the database.

Automated Input Verification

During data input, Manager Neighborhood checks for incomplete, incorrect or inconsistent data. For instance, if a manager indicates that they use prior firm performance returns or simulated returns, the application will not allow the manager to exit the page without inputting a start or end date, ensuring that all data is complete.

Managers cannot input data that conflicts with data entered elsewhere in the application. For instance, the totals for assets in one area have to match the total in another area.

There are hundreds of automated checks run within Manager Neighborhood during the input process to prevent such incompleteness or inconsistency.

Manual Input Verification

In addition to the automated system checks, each new entry is reviewed by an experienced data analyst for consistency. Analysts will contact the manager when any of the following occurs:

· Data is inconsistent relative to the manager’s own historical information

· Data is inconsistent relative to market standards

· Data is inconsistent relative to other managers who manage similar products

Until the data verification is made, no new data will be uploaded to the database.

Change Verification

Whenever a manager makes a change to an entry, the data analyst specifically assigned to that manager is notified of the change. The data analyst receives a statement noting both the previous entry and the new entry. If the new entry varies significantly from the previous entry, the analyst will contact the manager to verify that the data is correct. Until this verification is made no new data will be uploaded to the database.

Pre-production Check

Prior to the final data being uploaded to the PSN database, there are additional automated checks that are run before the production cycle begins. Some examples of checks done at this phase of the process include the following:

· Duplicate firm names and duplicate product names under the same firm. Names do not have to match exactly for an alert to occur. Similar names will be flagged for the data analyst to manually review.

· Products that are reporting returns for a future date.

· Products that have no returns in any monthly or quarterly table.

· Firm/product “orphans”. Products must have an accompanying firm and each firm must have at least one product.

As with the other sets of checks, no data is published until all issues have been resolved.

Informa employs this meticulous data verification process to make certain that you are accessing information that has been continuously validated.

Questions about the data? Simply contact Client Service. Client service will inform the Data Services department who will immediately contact the investment manager in question.

Users can call or email the Client Service division with any suggestion about manager inclusion or data. Some clients ask us to solicit a manager to join our database so they can remain anonymous. Other clients will call the investment manager directly and tell them to join PSN.

To satisfy the needs of our diverse client base, Informa Investment Solutions is constantly on the lookout for new managers and investment products. Many of our clients make inclusion in PSN the mandatory starting point for all their searches.

We welcome your suggestions and referrals for firms and/or products: simply send your request to psndata@informais.com and we will do the rest. If you prefer, you can contact the manager and ask the manager to send us the information listed below.

An investment management firm can participate in the PSN database by sending an e-mail to psndata@informais.com with the following information:

1. Firm

v Name

v Address

v Assets under management

2. Data Contact information (the data contact is responsible for submitting the required information and communicating with Informa Investment Solutions on any data issues)

v Name

v Telephone number

v E-mail Address

3. Product List

v Specify the product name and asset class.

Upon receiving that email, the Data Services department of Informa Investment Solutions will set up the new database participant, and contact the Data Contact. The Data Contact can then provide complete data through Manager Neighborhood.

PSN Enterprise is a web-based application. Each licensed user is assigned a Login Name and Password to access PSN Enterprise on our company’s web site: www.informais.com. The information (graph and report templates, universes, custom templates, batched presentations, self-entered products and hybrids) created under the user’s Login Name and Password is proprietary to the user.

PSN Enterprise is comprised of the following:

Selection

Selection is the first screen to appear when you open PSN. This screen allows the user to locate and select the product(s) or retrieve a specific universe (either a PSN Published Universe or a User Created Universe) to view (and select the product(s) within this universe) before going to the Report area to generate graphs, reports or Firm/Product profiles.

Search

The Search screen allows the user to screen for a universe by selecting from the criteria listed in the Search Toolbar. The criteria available consist of Firm level data information (Firm Basics) and Product level (Product Basics) data information. The user can also screen for a universe based on statistical performance (Statistics or Advanced Stats).

Logic

Takes manager research and reporting to an important next level. Logic enables investment professionals to apply and effectively showcase their intellectual capital, fiduciary process, research philosophy and repeatable process.

Quick – Stat

The Quick-Stat screen allows the user to view calculated statistic performance for products, the product assigned benchmark, ADV Part I and II, Marketing Brochures, Compliance/Attestation Letter, Return Based Style Category breakdown, Latest Returns Available for products, Manager Web Site and Advanced View (create custom view).

Self-Entered System

The Self-Entered System is the user’s own input system. This allows the user to create or import proprietary products. This is maintained in PSN. The self-entered products can be used as a comparison against other products in the PSN database.

Hybrids

The Hybrid System allows the user to create hypothetical manager blends or index blends. Once created, the hybrid products can be used as a comparison against other products in the PSN database.

Reports

The Reports screen allows the user to create and save graphs, pre-set reports, custom reports (to export to Excel), Universe Reports and generate Firm and Product data and narrative profiles.

The Report Writer is located here. This function allows the user to create a custom report to export to Excel. Available to select: Firm Information, Product Information and Statistical Performance.

Depending on the PSN Version, the Statistics Writer function is also here. This function allows the user to create a statistical performance report which is exportable to Excel.

Batch Reports

The Batch Reports screen allows the user to compile graph templates (System and User Created), Firm and Product data and narrative profiles or Report Designer custom templates into a presentation. The presentation can then be generated in batch mode for multiple selected products. The output can be saved as a PDF file or PowerPoint file (graphs only). The saved presentation can be re-used again.

Report Designer

The Report Designer screen allows the user to create custom templates using available graphs, firm and product data and narrative information. The custom templates can be used again in the Reports and Batch Reports areas.

Setup

The Setup screen allows the user to re-set certain settings system wide. This includes system ending date, headings and footnotes in graphs and default colors and symbols in graphs.

Selection is the first screen to appear when you open PSN. At the Selection screen, you are able to:

Select the desired data set using the Data Set drop down list box

Retrieve PSN Published Universes by using the Universe drop down list box

Retrieve a saved universe by selecting the Retrieve Universe function

Search for a specific product using the Locate function

View a list of products and click on the Next Page button to see the next listing of products

Click the box next to the product name to select the product before proceeding to the Reports area

Within the Selection screen are the following functions:

Depending on your subscription, here are the available Data Sets:

ü Products (Gross of Fee)

ü Barclay Hedge Funds

ü Barclay Managed Futures

ü Lipper Mutual Funds

ü Market Indices

ü Morningstar Asia Pacific Funds

ü Morningstar Canada Funds

ü Morningstar Equities

ü Morningstar Europe Funds

ü Morningstar Exchange Traded Funds

ü Morningstar Close Ended Funds

ü Morningstar Global ETF Funds

ü Morningstar Middle East Funds

ü Morningstar Mutual Funds

ü Morningstar Off Shore Funds

ü Morningstar South Africa Funds

ü Morningstar United Kingdom Funds

ü Mutual Funds

ü Products – Net of Fee

ü SMA Indices

ü Self-Entered

ü Hybrids

For the entire help system, we will use the term “product or products” to indicate one or more items from one or more of the data sets listed above.

The universe drop down box lists the PSN Published Universes. There are two types of PSN Universes available. The first type is Manager Defined universes based on Primary Fields: Primary Investment Style, Primary Market Capitalization and for Fixed Income Primary Maturity. These Primary Fields are located in the Product Data Profile. A participating manager is asked to choose only one option for these fields.

The second type is Return Based Style Analysis (RBSA) universes. To retrieve a PSN Universe:

Click the Universe window drop down button

Highlight the name of the PSN Published Universe.

The firm/product count will be listed under the Universe drop down box.

Note: User created universes can also be selected from this drop down box.

In the Locate box, type in the first few letters of the firm name and click on the Go button.

Note: Use the Locate Option drop down window (click on >>) to locate a firm by: Any of the words, All of the words or Exact Phrase.

The Clear All button is used to turn off the selected products across all data sets. To turn off the checkmark(s) next to the product(s), click on the Clear All button.

This button is used to re-arrange the order of appearance (the selected products) in the graph legend. To use the function:

Use the Data Set drop down window to select the desired data set.

Use the Locate box to find the product(s).

Click the box next to the product name to turn on the checkmark to select the product (Note: Most graphs in PSN allow a maximum of 30 observations to be highlighted in the graph legend)

Click the Save/copy Selected button

Use the Up and Down arrow buttons to re-arrange the order

Click Reports on the main toolbar to go into the graphics/reports area OR click on the Save Current Selection button to save the selected products as a custom universe.

The Retrieve Universe button allows the user to retrieve user created universes. User created universes can be created using the Search function or by hand selecting the products to create a custom universe. To use this function:

Click the Retrieve Universe button

The Universe Directory screen will appear

Under the Name column to the left, locate and select the universe to retrieve

A reminder screen will appear, listing the Short Abbreviation, Description, Member Types, Screening Date, Members Count, List of Criteria used to create the Universe

At the bottom of the screen, click on the Load <name of saved universe> button.

Note: When you save a universe, it becomes a static universe. By clicking on the Load <name of saved universe> button, you are retrieving the same list of products that met your criteria at the time the Universe was created. If you want the universe to be dynamic (new products added to the saved universe over time), check off Update members after loading before clicking on the Load <name of saved universe> button. The system re- screens the universe with the same criteria listing. This function should be done on the 15th of every month when the manager database is updated.

Click the Retrieve Universe button located to the right side of the Selection screen

Under the Universe Directory, the saved universes and custom universes will be listed. Locate and place a checkmark in the square box to the far right of each saved universe or custom universe to be deleted

Click the Deleted Selected button at the bottom of the screen

This function is used when a manager is missing a return(s) for a product and you want to transfer the historical returns to the Self-Entered System. You have the option to enter the missing return(s) and save as a self-entered product. You can graph the product as a self- entered product:

At the Selection screen, locate and check off the square box next to each product(s). Use the Data Set drop down window to locate other product types (market index, self-entered product, hybrid, mutual fund, etc.).

Click the View Selected button

Click the Copy to Self-Entered button. A message will appear: Successfully copied

Select Self-Entered on the main tool bar

The Self-Entered Directory will appear

Under the Self-Entered name column, select the product copied over

The Edit Self-Entered screen will appear

Scroll down the screen to the historical return grid

Click inside the return box and enter the missing return (click on the Tab key to move over to the next box if necessary)

Click the Save button

Note: Only Products and Market Indices can be copied to self-entered.

The Select Universe button will be activated when the user retrieves a PSN Published Universe or a saved universe from the Universe drop down window. To use the function:

Click the Universe drop down button and highlight the universe to retrieve

Click the Select Universe button to turn on the checkmarks for all products

Click Reports on the main toolbar to go into the graphics/reports area and generate reports for the selected products OR click on the Export ROR button to export the historical returns to Excel.

The Export ROR button is used to export the historical returns of a retrieved universe. To use the function:

Click the Retrieve Universe button. The Universe Directory will appear

Under the Name column to the left, click on the saved universe name

The name of the selected saved universe will appear. Click on the Load <name of saved universe> button to retrieve the products in the saved universe

Locate the Select Universe button (to the right) at the bottom of the screen and click on it

The system will turn on the checkmarks for all the products

Click the Export ROR button

Choose the Period Type to export: Monthly or Quarterly

The system will export by default the historical returns for each product in the universe going back to inception (for the product). However, you have the option to specify the Begin Year and/or the End Year. Note: If the performance for a particular product starts AFTER the selected Begin Year, the inception date column will hold the actual inception date.

Click the Export ROR to Excel button

Note: This function is only available to PSN Platinum level Users

The Compare Selected function is used to isolate the selected products and view their performance. To use the function:

Use the Data Set drop down window to select the desired data set. Use the Locate box to find the product(s). Check off the box next to the product name to select the product.

Click the Compared Selected button

The Current Stat drop down window will appear. The window will default to the Rate of Return statistic. To view a different statistic, use the drop down button and re-select a statistic from the listing. Available dates shown on this screen are: Latest Month, Quarter, 1 Year, 2 Year, 3 Year, 4 Year, 5 Year, 6 Year, 7 Year, 8 Year, 9 Year and 10 Year.

At the Search screen, you are able to:

· Go to the Search area and construct a universe by selecting from the criteria listed.

· Click the View Results button to retrieve your new universe members and the corresponding product and manager count.

· Click the Save Universe button to save the results as a User Created Universe.

· Select a PSN Published Universe from the Universe drop-down box. Once the universe is selected, screen down the universe further by clicking on Search.

· Add screening criteria as required and then save your universe by clicking on Query and Keep Results as Universe or Save Universe buttons.

Select any criteria within the following categories:

Product level information including database and asset class, investment styles, market capitalization, decision making process, fixed maturity, fixed duration, AIMR-PPS/GIPS compliant, open for investment, offered as mutual/commingled fund, offered as wrap/tamp program, performance incentive fee, manager tenure, manager designated benchmark, wrap products and wrap sponsor.

Firm level information including location, type, legal structure, year founded, percentage owned by employees, total assets under management, tax-exempt and taxable assets, non-US assets, ownership, minority owned and firm ownership break-down.

Firm assets break-down by investment approaches (US Equity, US Fixed, US Balanced, US Cash, International Equity, International Fixed, International Balanced, International Cash, Global Equity, Global Fixed, Global Balanced and Global Cash), U.S. Tax Exempt, U.S. Taxable and Non-US client assets and client types.

Available for searching based on statistical performance. The Statistics screen is set up in a drop-down window format with the following:

Statistics against Benchmark

Select the statistic, time period, operator (greater than, less than, greater or equal and less or equal), relative to a selected benchmark

Statistics against Values

Select the statistic, time period, operator (greater than, less than, greater or equal and less or equal), relative to a selected minimum value, maximum value or a range in value.

Statistics against Percentile

Select the statistic, time period, and comparison universe, rank is (greater than, less than, greater or equal and less or equal) and Percentile

Note: Greater than=higher numerical percentile ranking

Less than=lower numerical percentile ranking

Select the Equity or Fixed Income investment styles for screening. The manager is asked to rank each investment style from 1 to 5: 1= Very Important, 2= Important, 3=Utilized, 4=Not Utilized and 5=Not Important.

Select a statistic(s) and enter a Custom Date range(s) for statistical performance screening.

Select Product Information in the following categories: Total Assets and Accounts, Fees and Portfolio Turnover, Assets and Accounts by Tax Status, Total Assets and Accounts by Account Type and Median Account Size.

Here are some of the available fields: Average Maturity, Average Duration, Average Yield to Maturity %, Average Coupon%, Quality Distribution, Sector Distribution, Maturity Distribution and Duration Distribution

Here are some of the available fields: % In ADR's Low and High, % In Ordinary Shares Low and High, % Cash Reserve Low and High, % In Hedged Low and High, of Stocks Low and High, Max in one Security %, Max in one Industry %, Max in one Sector %, Max in Equity % , (balanced products only), Max in U.S. %, Max in Single Non-U.S. Country %, Max Outside of U.S. %, Micro Capitalization (<500 $Million), Small Capitalization (>500 $Million - <2 $Billion), Medium Capitalization (2-10 $Billion), Large Capitalization (10-50 $Billion), Mega Capitalization (> 50 $Billion), Industry Sector Breakdown, Equity Characteristics.

Select Global Product information in the following categories: Query for Developed Countries, Query for Emerging Countries and Query for Geographic Regions.

Select the Firm and Product Narratives in the following categories:

Firm Narrative - Here are some of the available fields: Organization and Ownership, Product Offerings and Services, Business Objectives and Strategy, Investment Approaches, Senior Investment Professional information (Name, Professional Accreditation, Present Job Position, Undergraduate Institution, Previous Company Name, Responsibilities in this Firm, etc.)

Product Narrative - Here are some of the available fields: Investment Philosophy, Investment Decision-Making Process, Portfolio Construction, Investment Approach, Key Investment Officer information (Name, Professional Accreditation, Present Job Position, Undergraduate Institution, Previous Company Name, Responsibilities in this Firm, etc.)

View Results button

Click on this button anytime you wish to see the list (including manager and product count) that matched your criteria. To come back, click on the Search tab again.

Query and Keep Results as Universe button

Click on this button when you want to complete your current search session and save your criteria and the list of products.

Clear Criteria button

Click on this button when you want to start fresh, delete all of your current criteria and bring the entire universe of products back.

Save Universe button

Click on this button when you want to complete your current search session and save your criteria and the list of products.

Full Universe button

Click on this button when you want to delete all of your current criteria and bring the entire universe of products back.

Retrieve Universe button

Click on this button when you want to retrieve one of your saved universes.

Create a Universe Using the Search function:

Click the Search function on the main toolbar

Note: You can also retrieve a PSN Published Universe (from the Universe drop-down window at the Selection screen) as the starting point, and click Search to screen down further.

The Product Basics category will appear

· Select the desired Database and Asset Class: U.S. Equity, U.S. Fixed Income, U.S. Balanced, Non-U.S. Equity, Non-U.S. Fixed Income, Non-U.S. Balanced, Global Equity, Global Fixed Income and Global Balanced

· To create an Equity Universe: Under the Equity Options, select the desired Investment Style(s), Market Capitalization(s) or Equity Decision Making Process(s)

· To create a Universe Fixed Income: Under the Fixed Options, select the desired Fixed Income Style(s), Fixed Maturity(s), Fixed Decision Making(s) or Fixed Duration(s)

Note: At any time, to view your screening results, click the View Results button. The system will process the screening and show the current criteria selected and the current firm/product count. Click Search to go back or click the Save Universe button to save results as user universe.

· For Non-U.S. or Global Universe with a specific Geographic Concentration region, select the desired region in the Geographic Concentration:

Asian (Ex-Japan), Canadian, Continental Europe, EAFE, EAFE (Ex-Japan), EAFE (Ex-Pacific Basin), EAFE (Ex-UK), Emerging Markets (All Regions), Europe (Ex-UK), Europe (including UK), Global, International (Non-U.S.), Japan Only, Latin America, Other, Pacific (Ex-Japan), Pacific Basin or United Kingdom

· Select the desired Investment Approach: Index Enhanced, Index Passive or Active

· Under Other Options, select the desired product data fields. Here are some of the available fields: Offered as Mutual Fund, Offered as Commingle Fund, and Open for Investment, AIMR –PPS/GIPS Compliant

· Select the desired Minimum Fee and Account Size. Here are some of the available fields: Institutional or High Net Worth SMA Minimum Annual Fee and Account Size, Mutual Fund Minimum Annual Fee and Account Size, Hedge Fund Minimum Annual Fee and Account Size

· Other available product data fields to select for screening include: Manager Tenure, Weighted Average Market Cap, Manager Designated Benchmark and Wrap Sponsor

Note: At any time, to view your screening results, click the View Results button. The system will process the screening and show the current criteria selected and the current firm/product count. Click Search to go back or click the Save Universe button to save results as user universe.

· Select Firm Basics category to screen for firm information

· Select the desired Firm Location: City, State, Country

· Select the desired Firm Type, Legal Structure and Year Found and %Employee Owned

· Select the desired Firm Assets. Enter the minimum and/or maximum assets amount in Millions (i.e. 1000 = 1 Billion) for screening. Here are some of the available firm assets: Total Assets Under Management, Total U.S. Tax-Exempt Assets, Total U.S. Taxable Assets, Total U.S. Assets and Total Non-U.S. Assets

· Select to screen for Minority Owned (Yes or No)

· Select the desired Firm Ownership by entering the minimum and/or maximum percentage: American Indian/Alaskan Native, Hispanic, Women, Asian, African American, Disabled, Disabled Veteran and Overall

· Select the Assets Breakdown category to screen for Investment Approach and Client Assets:

· Select the desired Investment Approach. Enter the Minimum and/or Maximum value in Millions (i.e. 1000 = 1 Billion)

· Select the desired U.S. Tax Exempt client asset(s). Enter the Minimum and/or Maximum value in Millions (i.e. 1000 = 1 Billion)

· Select the desired U.S. Taxable client asset(s). Enter the Minimum and/or Maximum value in Millions (i.e. 1000 = 1 Billion)

· Select the desired Non-U.S. client asset(s). Enter the Minimum and/or Maximum value in Millions (i.e. 1000 = 1 Billion)

· Select Statistics category to screen based on performance. There are three options:

Statistics against Benchmark

From the drop-down boxes, select the statistic, time period, operator (greater than, less than, greater or equal and less or equal), relative to a selected benchmark

Statistics against Values

From the drop-down boxes, select the statistic, time period, operator (greater than, less than, greater or equal and less or equal), relative to a selected minimum value, maximum value or a range in value

Statistics against Percentile

From the drop-down boxes, select the statistic, time period, and comparison universe, rank is (greater than, less than, greater or equal and less or equal) and Percentile

Note: At any time, to view your screening results, click the View Results button. The system will process the screen and show the current criteria selected and the current firm/product count. Click Search to go back to screening or click the Save Universe button to save results as user universe.

· Select the Advanced Statistic (Adv Stats) category to screen based on performance

· Click the Select Statistic drop-down window to select the desired statistic. The Date Range box will appear

· In the Type of Date Range drop-down box, select the macro dates from the listing:

Latest Month, Latest Quarter, Year to Date, 1 Yr, 2 Yr, 3 Yr, 4 Yr, 5 Yr, 6 Yr, 7 Yr, 8 Yr, 9 Yr, 10 Yr

· To enter your own custom date, use the Date Range boxes. Type in the beginning date and the ending date

Note: For certain statistics, you are required to select an appropriate Risk Index. Select the risk index from the Risk Index drop-down box or click the orange button (with 3 dots) to bring up the Data Set drop-down box and select from the available data sets.

· You have the option to screen for products that outperform a Value. Enter the Minimum and/or Maximum Value

· Select the Period Type: Quarterly or Monthly. The system defaults is Quarterly

· You have the option to screen for products that outperform based on Percentile. Enter the desired percentile Minimum and/or Maximum Value

· Click OK button

· For Equity Universe, select the Product Information (Product Info) category to screen for: Product Total Assets and Accounts, Fees and Portfolio Turnover, Assets and Accounts by Tax Status, Total Assets and Accounts by Client Type, Median Account Size

· For Fixed Income Universe, select Fixed Income (Fixed) category to screen for: Average Maturity, Average Duration, Average Yield to Maturity %, Average Coupon %, Quality Distribution, Sector Distribution, Maturity Distribution and Duration Distribution

· For Non-U.S. or Global Universe, select Global to screen for:

Query for Developed Countries, Query for Emerging Countries and query for Geographic Regions

· Select the Narratives category to screen for qualitative information in the Firm and Product Narratives. The available fields include:

Firm Narrative - Here are some of the available fields: Organization and Ownership, Product Offerings and Services, Business Objectives and Strategy, Investment Approaches, Senior Investment Professional information (Name, Professional Accreditation, Present Job Position, Undergraduate Institution, Previous Company Name, Responsibilities in this Firm, etc.)

Product Narrative - Here are some of the available fields: Investment Philosophy, Investment Decision-Making Process, Portfolio Construction, Investment Approach, Key Investment Officer information (Name, Professional Accreditation, Present Job Position, Undergraduate Institution, Previous Company Name, Responsibilities in this Firm, etc.)

· Click the View Results button to process the screening

· Click the Save Universe button to save results as a user universe.

· At the Selection screen, locate and check off the square box next to each product(s). Use the Data Set drop down window to locate other product types (market index, self-entered product, hybrid, mutual fund, etc.).

· Click on the View Selected button

· All the selected products will be listed in the window. Use the black Up and Down buttons to the right of the screen to change the order of appearance. (Note: the order of appearance will be saved. This will be the same order as seen in the legend of the graph(s) when you go to the Reports area).

· Click on Save Current Selection button

· Enter Short Abbreviation and Description for the universe and click the Save button

· At the Selection screen on the main tool bar, click Retrieve Universe button (located in the upper right hand corner of the screen)

· Click Create Merged button

· Enter the name of the merged universe (Short Abbrev/Description)

· Under Universe Option, select the universe type (PSN Published Universes, Non-Published Universes, etc). The universes will be loaded into the window for you to select

· Select the universe and click the > button to add to the Universe to be Included window. Repeat to add more.

· Click Save button

· The Universe Directory screen will appear. The merged universe will be listed

· To retrieve the merged universe, under the Name column, select the universe name and click on Load <name of universe> button

Logic enables investment professionals to efficiently apply and effectively showcase their

· Intellectual capital

· Fiduciary process

· Research philosophy

· Repeatable process

Every great database has a search and selection function that allows the pros to screen managers down to a select list or finalists; only Logic allows you to show which ones fell from the list at each stage and why. And, only Logic satisfies the increasing need to demonstrate fiduciary responsibility and a repeatable process. Logic is immediately available to PSN Enterprise Platinum subscribers. · On the fly Pass/Fail analysis allows the user to see search constituents who are successful or unsuccessful for inclusion in the search · Breakdowns for constituents can be done for individual search criteria or the cumulative set of selected criteria · “Force Pass/Fail provides the user the authority to be inclusive or exclusive of products that have either failed or passed the search · “Report Card” offers the user to have more transparency into a product’s performance, providing the ability to drill in on a particular manager to see why they passed or failed specific criteria. · Advanced Report Writer delivers on the fly previews of selected criteria, search column definition, advanced sorting with drag and drop functionality, and a “ghost filter” mode for masking criteria from the final report. · Smart Exporting gives the user the ability to export their custom reports to Excel with a record of the Filter Constituents and their individual and cumulative pass/fail analysis · New Criteria Search enables the user to quickly and easily find criteria by name for use within a product search enabling prioritization of criteria within a research construct. · “Beats” functionally allows querying based on exceeding a benchmark, over a percentage of multiple time frames, for each criterion. Similar to PSN’s Batting Average, Beats can be calculated for every statistic. · Formula feature allows for the creation of custom algorithms for assigning weightings to specific criteria for use within queries and numeric function allows numeric values to be assigned to non-numeric criteria for use within queries. · All queries can easily be seen in PSN’s “Quick View” Reports, be saved as universes, and shared across the enterprise. |

Put Logic to work for you today! Contact PSN Client Services today for a personalized tour or training on Logic or any aspect of PSN’s manager research and due diligence solutions.

Contacts

www.informais.com

clientservices@informais.com

914-509-1577

The Quick-Stat screen allows the user to view: (this function is not available for Self Entered and Hybrid Products:

· Calculated statistic performance for selected universe. This can be exported to Excel.

· Product assigned benchmark: PSN designated and Manager designated

· ADV Part I and II, Marketing Brochures, Compliance /Attestation Letter. The user can view the information on-line or save as PDF file

· Return Based Style Category breakdown

· Latest returns available for products. Returns are posted the next business day in PSN

· Manager Web Site

· Advance View allows user to create custom performance and data columns to view and export to Excel

Available functions under Quick-Stat:

The Statistic screen shows calculated performance for a selected statistic (use the Current Stat drop down window to choose the desired statistic.) Available dates shown on this screen are: Latest Month, Quarter, 1 Year, 2 Year, 3 Year, 4 Year, 5 Year, 6 Year, 7 Year, 8 Year, 9 Year and 10 Year. To sort performance descending, click once on the column header name. The Statistics screen is refreshed on the 15th of every month.

Returns are refreshed on the next business day after a manager updates their performance. The Latest screen allows the user to view the latest returns as of that day. You can also view the returns prior to the latest year by clicking on the Year drop down window to the right of the screen.

The Advance View function allows the user to re-select the performance/data columns to view. The user can also save this view. To create a new view and export to Excel:

Note:Advance View only works with Data Set: PRODUCTS. Load a universe or select the desired product(s) at the Selection screen before going to Advance View

Click the New View button located at the bottom of the screen

Enter the name of the view in the View Name box

Under the Available Fields window locate and select the field(s)

Click the Save button. The saved view listing will appear

Highlight the view to generate

Click the Back to Advance View button to process the view on screen

Click the Export to Excel button at the bottom of the screen to export the view to Excel

The Benchmarks screen lists the PSN Designated Benchmark for the product (each product is assigned a PSN default benchmark base on how the manager completes the Primary Investment Style, Primary Market Capitalization and for Fixed Income Primary Maturity fields in the Product Data Profile), the Manager’s Designated Benchmark selection and the product’s assignment to a PSN Published Universe.

The Return Based Style Analysis category breaks-down (T-Bills, Large Value, Large Growth, Medium Value, Medium Growth, Small Value, and Small Growth).

The product’s ADV Part I, ADV Part II, Marketing Brochures and Compliance/ Attestation and a short video. Letter are available to view online or download by saving as a PDF file.

This screen allows the user to click on the manager’s web link to go directly to the manager’s home web site to do more research.

Universe count gives you the count of available managers within a universe and the count of how many have data as of the current quarter.

The Self-Entered System is located on the main tool bar. This is the user’s input system for proprietary return sets (products, indexes and portfolios). The user has the option to maintain a separate database in PSN using the Self-Entered System. Once the self-entered product is saved, it is available to be graphed with other products in the PSN database. To create a self-entered product:

· Select Self-Entered located on the main tool bar

· Select New Self-Entered

· Enter the Firm Abbrev

· Enter the Product Abbrev

· Enter the Description

· Enter the Date as of Date (this field is option, you can leave it blank)

· Select Period Type: Quarterly or Monthly

The following fields are optional (you can leave them blank):

Assets

Type

Default Return Type

Scope

Primary Investment Style

Primary Market Cap

Primary Maturity

Primary Decision Making

The following two fields you may want to use:

Default Benchmark

Default Universe

· You have the option to assign a Default Benchmark or a Default Universe for the self-entered product. In the Reports area under the Single Manager tab (manager versus benchmark analysis); the system will bring up the assigned benchmark for the self-entered product as comparison. If you create any universe charts, the system will also bring up the assigned universe.

· Enter the inception year in the Performance begins on year (yyyy) box. This field is required to generate the ROR grid for inputting returns. Click the Accept button.

· The historical return grid will appear at the bottom of the screen. Enter the returns. Click the Tab key to move over to the next box.

· Click the Save button

Note:If you have the historical returns in Excel with the following: Single column format, left justified, Earliest Dates to Latest dates from top to bottom and negative number using minus sign (no brackets), you can select the Import Historical Rates of Returns button:

· Step 1 - Enter the first quarter or month for which you have return information

· Step 2 - Copy and Paste the returns from Excel spreadsheet to the available window

· Step 3 - Click OK button

· Click the Close Window button to go back to the main Self-Entered screen

· Click the Save button

You can use the Upload Center function to import a large number of self-entered products into PSN. The import file has to be in the PSN specified format:

Upload Rules:

· Your file must be a comma separate value ("CSV") file.

· Your CSV file cannot exceed 500K. Depending on the performance history of each record, this roughly translates to 500 self-entered products or so.

· Each record must be completed and dictated by the RECORD FORMAT for the Upload Center.

· Once the upload process is started, you can proceed to perform other tasks in PSN Enterprise.

· If a record is new, that record will be inserted into the system by the upload process.

· If a record currently exists in PSN Enterprise, it will be updated by the upload process.

· An email will be sent to your inbox once the entire upload process is completed.

Each record in the CSV file must be in the following format ("RECORD FORMAT"):

· Each data field must be separated by a comma.

· Text must be surrounded with quotation marks.

· Number and date must have no quotation mark.

· Each data field is provided from left to right as indicated below:

o Firm Abbreviation ("20 characters max")

o Product Abbreviation ("20 characters max")

o Description ("60 characters max")

o Product ("36 characters max")

o Return Type ("Pre-tax gross of fees", "Pre-tax net of fees")

o Period Type ("Monthly or Quarterly")

o Fiscal Year End Month (12)

o Performance Begin Date (mm/yyyy)

o Performance Values (#1, #2, #3, … #n)

To proceed, please select a Comma Separated Value (CSV) file to upload:

· Click the "Browse" button

· Find a file on your computer and select it

· Click the "Open" button

· After file is selected, click the "Upload" button

· Once the process is completed, you will receive a confirmation e-mail from IIS informing you of the status of your upload.

· Once the self-entered product is saved, it will be available for you to select for reporting. To select the self-entered product, go to the Selection screen. In the Data Set drop down window, bring up the Self-Entered listing.

The Hybrid System is located on the main tool bar. It is a powerful tool that allows the blending of any combination of manager returns and market indexes to help you determine what mixture of products will meet your risk and return criteria. PSN will calculate the performance of the hybrid based upon your mixture and re-balancing criteria. The hybrid can be profiled and incorporated in any graph or report as a separate product.

· At the Selection screen, locate and select the members to create your hybrid

· Select Hybrids on the main toolbar

· Under Options, type in the Hybrid Name and the Description

· Select one of the following in Mixing Mode:

o If member has no ROR for a period, rebalance its % to the rest of the members

o If member has no ROR for a period, make hybrid ROR = N/A from this period on

· Type in the Initial Amount (optional). Use this option if you want to generate the hybrid mixing results to export to Excel or to proceed to the Advanced function to add Contributions, Withdrawals and Fees.

· The default Time Period is Common (The system will find the common start date for all members). You have the option to select the following Time Periods:

Longest - System selects start date based on product with the greatest longevity.

Other - Use if you want to select a specific quarter/month start date by entering Start Date field with the user selected date.

· Select the Rebalance Period from drop down menu requiring the system to restore the original percentage allocations to the blend members for the period selected. System defaults to No Rebalance.

· Type in the percentage for each member under the Allocation % column (total must equal to 100%)

· To create a custom benchmark for your manager blend, select I want to Build Custom Benchmark. The system will choose a default benchmark for each item using the same allocations as those applied to the hybrid members. The user can re-select the benchmark by using the drop down box to the right of the item. Select the appropriate risk index for each member.

· Under the Advanced button, you have the option to set up Contributions/Withdrawal, Add Fees and Add Rebalanced Thresholds for your hybrid:

· In the Product drop-down box, select member

· In the Beginning Date drop-down box, select the beginning date (the default date is the common date for all members)

· In the Frequency drop-down box, select the frequency

· In the Amount drop-down box, type in the dollar amount (i.e.: 10,000). Use minus sign for Withdrawal (i.e.: -10,000)

· Click the OK button

· Click on Apply button

· In the Product drop-down box, select All Manager or a specific member

· In the Beginning Date drop-down box, select the beginning date (the default date is the common date for all members)

· In the Frequency drop-down box, select the frequency

· In the Percent drop-down box, type in the fee percentage (i.e.: ten percent = 10)

· Check off the De-annualize if you want the system to proportion the annual fee percentage for each member on a quarterly basis

· (i.e.: select quarterly frequency and check off De-annualize)

· Click the OK button

· Click on Apply button

Add Rebalance Threshold:

· This function allows the user to set the allocation limit for each member. For example, if the initial weighting for member A is 75% and the actual allocation (based on performance) is 90%, you can apply an Up Threshold of 10, which means the system will force a rebalance (back to 75%) if the actual allocation for the member exceeds 85%.

· In the Product drop-down box, select the member you want to set the threshold

· In the Up Threshold drop-down box, enter the offset from the initial allocation. If the actual allocation goes above the initial %, plus this offset, the system will force rebalance

· In the Down Threshold drop-down box, enter the offset from the initial allocation. If the actual allocation goes below initial %, minus this offset, the system will force rebalance

· Click the OK button

· Click the Apply button

· Once all desired settings have been applied, click the Save Mix button to save the Hybrid

· Click the Blended Results button to view the mixing report. Click on Export to Excel button to extract mixing report to Excel

· Click the Return & Risk button to view the saved hybrid statistics: ROR, Standard Deviation and Dollar Growth.

· Once the Hybrid product is saved, it will be available for you to select for reporting. To select the Hybrid product, go to the Selection screen. In the Data Set drop down window, bring up the Hybrid listing.

Asset Allocation Optimizer

This function is located in the Hybrids area. It is used to find an optimal solution (preferred percentages) that is efficient in building the hybrid (Note: make sure all members have same end date).

The information is viewed on the screen.

· At the Selection screen, locate and select the members to create your hybrid

· Select Hybrids on the main toolbar

· Select Hybrids

· Under Options, type in the Hybrid Name and the Description

· Select one of the following the Mixing Mode:

If member has no ROR for a period, rebalance its % to the rest of the members

If member has no ROR for a period, make hybrid ROR = N/A from this period on

· Type in the Initial Amount (optional). Use this option if you want to generate the hybrid mixing results to export to Excel or to proceed to the Advanced function to add Contributions, Withdrawals and Fees

· The default Time Period is Common (The system will find the common start date for all members). You have the option to select the following Time Periods:

Longest - System selects start date based on product with the greatest longevity.

Other - Use if you want to select a specific quarter/month start date by entering Start Date field with the user selected date.

· Select the Rebalance Period from drop down menu requiring the system to restore the original percentage allocations to the blend members for the period selected. System defaults to No Rebalance.

· Click on Select Optimal Solution button

· Under Chart Parameters to the left, select Allocate Manager Selection for manager blend or Allocate Indices Selection for index blend

· To the right of the screen is the Efficient Frontier curve. Each point on the curve represents the return versus risk tolerance.

· Select a point that represents your return versus risk tolerance. The system will apply the appropriate allocation for each member based on your selection.

· Click on Accept button at the bottom left of the screen to go back to the Hybrids/Options screen. The system will re-apply the percentage for each member based on the Risk Tolerance point selection.

· Click the Save Mix button

Additional Options:

Allocation– Shows the ROR, standard deviation and allocation for each point on the efficient frontier curve. It allows you to sort and select a point.

Correlation – Shows how the members correlate to each other. It allows you to edit the correlation matrix and/or ROR and Standard Deviation.

Best/Worst– Shows the best and worst returns (calendar years) and the best and worst risk (rolling three years) for the members

Risk Tolerance – Shows the color-coded risk legend from low risk to high risk

Constraints – Allows the user to apply minimum and maximum allocations for each member

Group Constraints– Allows the user to link more than one member together as a group and apply minimum and maximum allocations for the group.

The Monte Carlo function is located in the Hybrids area. Thisfunction allows the user to apply the available parameter settings to view the probability of growth over time for the portfolio.

The information is viewed on the screen.

How to use the Monte Carlo function:

· At the Selection screen, locate and select the members to create your hybrid

· Select Hybrids on the main toolbar

· Under Options, type in the Hybrid Name and the Description

· Select one of the following

the Mixing Mode:

If member has no ROR for a period, rebalance its % to the rest of the

members

If member has no ROR for a period, make hybrid ROR = N/A from this period on

· Type in the Initial Amount (optional). Use this option if you want to generate the hybrid mixing results to export to Excel or to proceed to the Advanced function to add Contributions, Withdrawals and Fees

· The default Time Period is Common (The system will find the common start date for all members). You have the option to select the following Time Periods:

Longest - System selects start date based on product with the greatest longevity.

Other - Use if you want to select a specific quarter/month start date by entering Start Date field with the user selected date.

· Select the Rebalance Period from drop down menu requiring the system to restore the original percentage allocations to the blend members for the period selected. System defaults to No Rebalance.

· Type in the percentage for each member under the Allocation % column (total must equal to 100%).

· Select the Monte Carlo button.

· The Monte Carlo Simulation screen will appear.

· The Parameters listing is located on the left side of the screen. Available parameters to apply:

Number of Iterations – The default is 1000. You can enter another value from 500 to 5000.

Inflation Rate – Enter the desired inflation rate

Target Value – Enter the desired target value

Target Annual Return- Enter the desired target annual return

Initial Amount- Enter to desired initial amount (i.e. $1 Million entered as 1000000)

Time Horizon (Years) – Enter the time frame in years

Note:The Annual ROR and Standard Deviation values listed are based on the historical returns of the hybrid

· Click the Accept button

· The results will be shown on two graphs located on the left side of the screens:

Probability on Growth

This graph will plot (in a line format) the growth of the Portfolio Value over Time and the probability in percentage of achieving the expected growth.

Range of Asset Values

This graph will plot (in a bar format) the growth of the Portfolio Value over Time.

· Click the Back button to go back to the Hybrids/Options screen.

Note:The Monte Carlo button is also located in the Asset Allocation Optimizer.

The Reports screen allows the user to generate:

· Graphs

· PSN Profiles

· Report Writer

· Universe Reports

· Report Designer custom templates

Export Graphs

All graphs and reports are generated by default in a PDF file format. However, the user can click on the Export button at the bottom of the screen to export to: Microsoft PowerPoint, Word, Excel or Windows Metafile.

Maximum Dates and Statistics

For Multiple Dates graph templates, you have the option to select up to 12 dates. For Multiple Statistics graph templates, you have the option to select up to 12 statistics.

The Reports screen is divided into two areas. The graph or report output is on the right side. The menu is on the left side of the screen and listed in a tab format. Here are the available tabs:

Available system graph and report templates that can accommodate up to 30 observations (products, risk indexes, mutual funds, self-entered products and hybrids); the Report Writer (or Statistics Writer) is also located here.

Available system graph and report templates that can accommodate only one selected product and the PSN Default Benchmark for the product (Note: the user can re-select the benchmark); manager versus benchmark analysis.

Available system graph and report templates that will let the user create and graph a custom manager blend or index blend on the fly with the option to save the hybrid blend. The graph format is the same as Single Manager: Only one Product versus Benchmark analysis.

Available system graph and report templates that will let the user create and graph a custom manager blend or index blend on the fly with the option to save the hybrid blend. The user is able to add “multiple scenarios” of differing percentage allocations for of the blend members and rebalance modes of the hybrid. The multiple scenarios will be listed in the graph(s) for comparison.

The PSN Profiles display all the data available for PSN Firm and Product listings within multiple profile formats. Depending on your subscription level these may include:

· Executive Summary

· Executive Summary 11

· Firm Assets- Client Type

· Firm Data

· Firm Narrative

· Firm Policy & Procedures

· Firm Summary

· Performance Historical ROR by Period

· Performance ROR vs Benchmark

· Performance Summary

· Product Assets - Historical

· Product Assets – Summary

· Product Data Profile

· Product Fee Summary

· Product Holdings –Full

· Product Holdings - Summary

· Product Narrative

The PSN Profiles can be saved as a PDF file.

· ADV Part I and II

· Compliance and Attestation Letters

· Marketing Brochures

The user can download the information by saving it as a PDF file.

Best and Worst Performers- Select the universe, the statistic and one date. This report highlights the Best and Worst performers within the universe. The use has the option to select the number of products to highlight (i.e. the top 10 and the bottom 10).

Distribution Threshold- Select the universe, the statistic and multiple dates. This report allows the user to highlight the universe in different tiles (user enters the desired tile, it can be 10, 20, 25, etc.) for multiple date ranges.

Percentile Report- Select up to 8 universes and up to 8 system macro dates. The report highlights the Distribution break down (High, First Quartile, Median, Third Quartile, Low and Mean) for each selected universe.

Percentile Writer- Select the products (to generate the report), multiple statistics, multiple dates and universes. This report shows the value and the percentile ranking for each selected products within the selected Universe. Also included is the distribution break down for each statistic (High, First Quartile, Median, Third Quartile, Low and Mean).

Universe Fee - Select up to 8 universes and one date. This report highlights the Distribution break down (High, First Quartile, Median, Third Quartile, Low and Mean) for $Million Account Size, $5 Million Account Size, $10 Million Account Size, $25 Million Account Size, $50 Million Account Size and $100 Million Account Size. The dollar amount is in thousands.

Universe Percentile- Select one universe, select one statistic with multiple dates or one date with multiple dates. This report highlights the percentile ranking and value for each product within the selected universe. All the Universe Reports can be export to Excel.

Graph and Report Templates previously created and saved by the user.

Reports uploaded from an external source. Available file format to import: Adobe PDF, Microsoft Word, Excel, PowerPoint and Text file. Once uploaded into PSN, it is saved as a template. The uploaded template can now be used in the Batch Report area to create presentation.

These are Graph and Report Templates previously saved by the user and transferred (by the user) to this Public Folder. This function allows the user to share the saved templates with other colleagues (they must be assigned user licenses to access to PSN). In order for this function to work, everyone (PSN user licenses) must be grouped together under a department name (i.e. Marketing, Research, etc.) by PSN.

These are the customized templates created and saved by the user using the Report Designer function on the main toolbar. Please see: Report Designer in section 3

This function allows the user to create and build a custom benchmark (index blend) to use as a comparison for the selected product under the Single Manager tab. To create a Custom Benchmark:

· Click Custom Benchmark located on top of the main Reports screen

· Use the Type drop down box to locate and select the members to build a custom benchmark. Available types include: market indexes, products, self-entered products, mutual funds, etc.

· Click Next button

· Enter the name in the Custom Benchmark box

· Enter the description in the Description box

· Select Mixing Mode

· Select Time Period

· Select Rebalance Period

· Enter the percentage allocation for each member. The total has to equal to 100%

· Click Finish button

To use the Custom Benchmark created:

· Go to Single Manager Tab

· Select the graph to generate

· In the Benchmark dropdown window located on top of the main Reports screen, scroll down the market index list and highlight Custom Benchmark to activate the one just created. Any graphs selected under the Single Manager tab will now show the selected product versus the custom benchmark created.

This function allows you to add your current graph or report as displayed on the screen to your current proposal. Once added, you can continue with one of the following:

· To change the order of the profiles and graphs selected, highlight the report that you want to change from the Compile window and use the Up and Down arrow buttons to the right of the list to re-arrange the order.

· Click on the Add More button if you want to continue adding graphs or reports to your current proposal

· To delete any of the selected profiles or graphs, highlight the profile or graph and click on the Delete Highlighted button

· Click on the Compile button to preview the proposal

· Click on the Save (floppy disk) icon at the top of the PDF window to save the final proposal to a PDF file.

· Select file name and where to save the file and click on the Save button to continue.

· Click on the Print icon to the right of the Save icon to print the current proposal

Note: The Add to Proposal function allows you to compile graphs and reports “on the fly”. The proposal will not be saved in PSN. If you would like the system to save your presentations, use the Batch Reports function located on the main tool bar.

· Click Import Logo located on top of the main Reports screen

· Click the Browse button to locate the logo file to import.

Acceptable Logo File Format:

Only JPG and GIF formats

Maximum file size is 200K

Indexed 256-Colors (8 bit)

Maximum amount of 128 colors in color table

No compressions including LZW compression

100 x 50 pixels is recommended

· Click the Upload button

· You can use the Logo Attributes to specify logo size and placement

Note: The No Logo button allows you to view a report without a logo. To bring back the PSN logo, click onto the PSN Logo button. This button does not appear if PSN logo is the current default.

For selected graph only. Click on this function if you want to specify your preferred color for each observation plotted on a report or graph. To modify the color, click on the color box for the one you want to change. Select the new color from this grid and click on the Graph button to continue.

The Import Reports function allows you to upload reports from an external source. Available file format to import: Adobe PDF, Microsoft Word, Excel, PowerPoint and Text file. Once uploaded into PSN, it is saved as a template. The uploaded template can now be used in the Batch Report area to create presentation or the Add to Proposal function. How to import an external report:

· Click Import Reports located on top of the Reports screen

· Click the Import New Report button

· Enter the name in the Report Name box

· Click the Upload button

· Click on Save button

· Click the Browse button

· Locate the report file to import and click Open button

· Click the Upload button

· The external report is now listed as a template in the User Uploaded Reports tab

Allows you to quickly change any default graph settings or to roll the system ending date to selected ending date.

The Custom Name function allows you to re-label the names of the products as shown by default in the graph legend. Enter the new name under the Custom Description box for each product. Click the Graph button to generate to output. This function is used “on the fly”. This will not be saved in the template.

Save Template

The Save Template button will save the modified graph or report as a private template for later retrieval. The saved template will be listed under the Private Templates tab.

Delete Template

Click on this button if you want to delete one or more previously saved report templates.

Export

The Export button will export the current graph and report to an external working environment. These include: MS Power Point, MS Word, MS Excel, Windows Metafile and Adobe Acrobat. To export this report or graph, choose the environment that you want. Click on the Download button to continue. You will be prompted to save or to open to file.

Report Writer